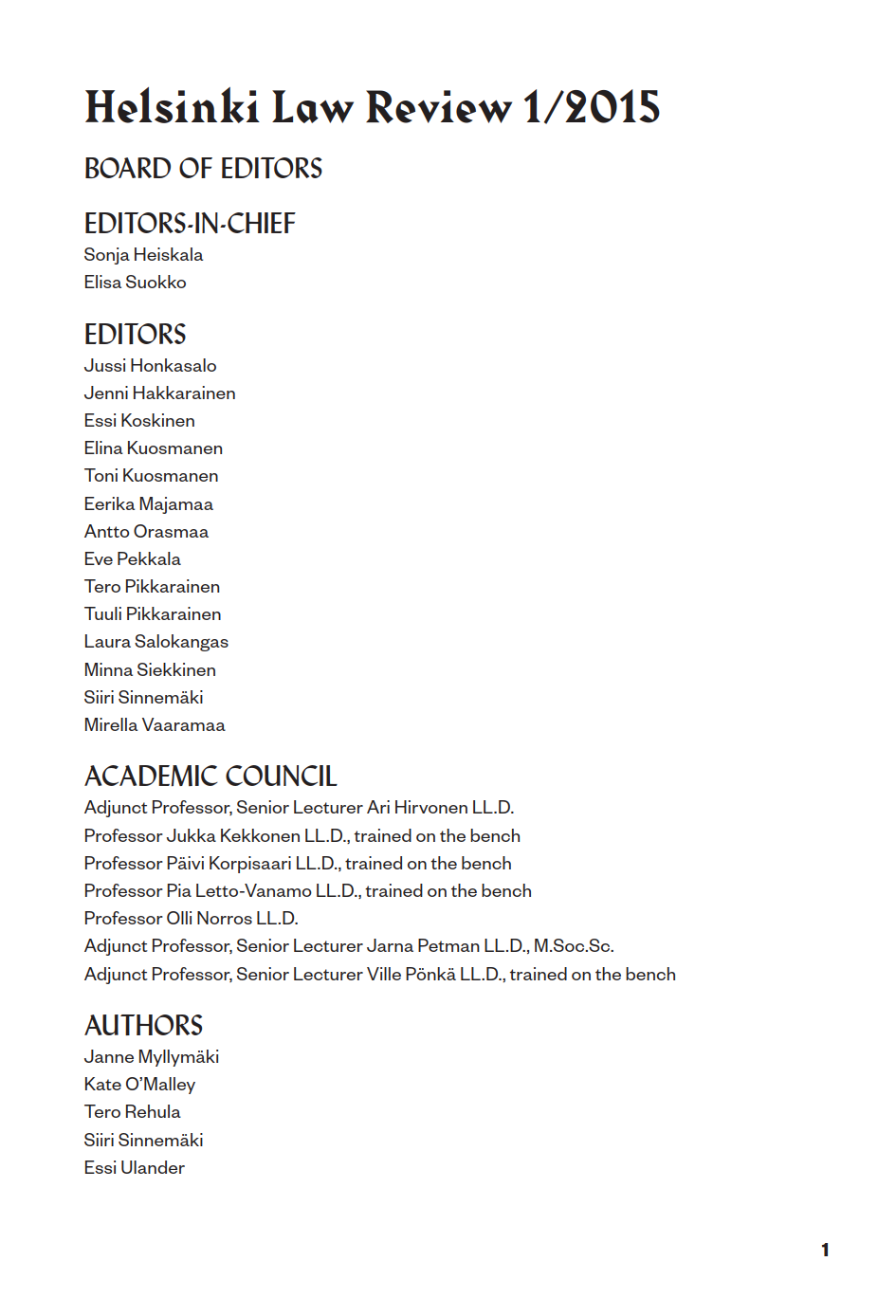

Sopimusperusteinen luoton alistaminen rahoitus- ja vakuusinstrumenttina Suomen oikeudessa

Abstract

Debt subordination, where the junior debt is subordinated to the senior debt, has become a widely used financial technique in different transactions, such as leveraged buy-outs, mezzanine financing, project financing and securitization. Debt subordination can be based on a credit agreement between the debtor and the junior creditor or on an intercreditor agreement (ICA) between the junior creditor and the senior creditor, the latter being the more widely used option. Despite its wide usage as a financial instrument also in Finland, debt subordination is not directly based on legislation in the Finnish juridical system. This article reviews different legal interpretations of debt subordination through existing legal structures and financial and collateral instruments of the Finnish juridical system so as to answer to the question concerning the effectiveness of a subordination agreement in i) insolvency of the debtor and ii) insolvency of the junior creditor. The main conclusion of the article is that any uncertainty related to the effectiveness of a financial instrument will hinder the estimation of related risk and lead to higher profit demands. Respectively, such uncertainties may have negative impacts on the functioning of the financial market.